how do i pay my personal property tax in richmond va

Offered by City of Richmond Virginia. Personal Property Tax The Commissioner of the Revenues office is open for walk-in service.

What Is Local Income Tax Types States With Local Income Tax More

Is more than 50 of the vehicles annual mileage used as a business.

. Be used 50 or less for business. Using your banks online bill pay Enter your account number exactly as it appears on your tax bill including letters and dashes In Office or by Phone Payment Drop box is located to the left of the main entrance of the County Administration Center By Mail Stafford County Treasurer PO. Please see the following list for possible bill adjustment reasons and information needed.

To pay the current Personal Property bill only or to add a bill using another Web application press the Checkout button. Our app will find out if you have all the qualifications to reduce your property tax expenses in the Old Dominion. Interest at a rate of 10 per annum is added beginning the 1st day of the month following the original due date.

Back to Top View Bill Detail Screen Checkout Pay another PP Bill Return to Search. If you have questions about personal property tax or real estate tax contact your local tax office. Please note that a 3 percent convenience fee applies with any creditdebit card payment.

Also if it is a combination bill please include both the personal property tax amount and VLF amount as a grand total for each tax account number. Please contact us at 540 853-2521 or personalpropertyroanokevagov for Personal Property Tax service. Mailing Address P.

You have the option to pay by credit card or electronic check. If you have questions about your personal property bill or would like to discuss the value assigned to your vehicle please contact the Department of Finance by phone at 804 501-4263 email at taxhelphenricous or fax at 804 501-5288. There is a convenience fee for these transactions.

Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia. Based on the type of payments you want to make you can choose to pay by these options. Pay By Phone Dial 1-800-272-9829 using the Madison County Jurisdiction Code 6242.

Wilbur 1 year ago. Monday - Friday 8am - 5pm Mayor Levar Stoney. Admissions Lodging and Meals Taxes Online Payment Parking Violations Online Payment Real Estate and Personal Property Taxes Online Payment 900 E.

Department of Finance 4301 East Parham Road Henrico VA 23228. Access DoNotPay Locate and choose the Property Tax product Provide some information about the property you own Answer some questions about yourself and your property. Pay Your Bill Chesterfield County levies a tax each calendar year on personal property with situs in the county.

Looking for bill adjustment. Finance Main Number 804 501-4729. You can pay your personal property tax through your online bank account.

Payment of the Personal Property Tax is normally due each year by October 5 see Tax Bill for due date. Voucher 2-4 payments are processed by the Richmond County Treasurer. Broad Street Richmond VA 23219 Hours.

Pay On-line httpstaxesmadisoncovirginiagov Please note that a convenience fee applies with any creditdebit card payment. 804646-7000 PAY NOW Pay Personal Property Taxes in the City of Richmond Virginia using this service AD AD Community QA You can ask any questions related to this service here. The fee is calculated prior to authorization so that you may either proceed or cancel the transaction.

Qualifications To qualify for the Personal Property Tax Relief a vehicle must. If your qualifying vehicles value is 1000 or less the Board of Supervisors has eliminated your tax. We will try to answer them soon.

If payment is late a 10 late payment penalty is assessed on the unpaid original tax balance. As June 5 falls on a Sunday all payments postmarked on or before June 6 will not be subject to penalties and interest for late payment. When you use this method to pay taxes please make a separate payment per tax account number.

Personal property tax bills have been mailed are available online and currently are due June 5 2022. You can make Personal Property and Real Estate Tax payments by phone. All payments should be made payable to the Richmond County Treasurer.

Use the map below to find your city or county. Personal property taxes on automobiles trucks motorcycles low speed vehicles and motor homes are prorated monthly. Directly from your bank account direct debit ACH credit initiated from your bank account Credit or debit card Check or money order Main navigation Payments Penalties Audits Bills Payments Individual Tax Payments Business Tax Payments Credit Card Payments.

Boats trailers and airplanes are not prorated. Paying Your Property Taxes Payment Options Online by Credit Card service fees apply Paying at your Financial Institution Online Banking Property Pre-Authorized Withdrawal PAWS Drop Box at City Hall By Mail In Person at City Hall Online Credit Card Payment Service Fees Apply. Personal Property Tax Rates Vehicles Autos trucks motorcycles and utility trailers are assessed on a prorated basis using the National Automobile Dealers Associations Blue Book NADA.

Virginia Department of Taxation For additional forms or information on other tax related items please contact the Virginia Department of Taxation at 1-804-367-8031. Answer the following questions to determine if your vehicle qualifies for personal property tax relief. You can choose the option of Post as Guest below to post anonymously.

Box 68 Stafford VA 22555-0068 Contact Us Treasurer Email. You only need to follow these fours steps. Be owned by an individual or leased by an individual under a contract requiring the individual to pay the personal property tax.

If the information shown is incorrect press the Return to Search button and return to the Pay Real Estate Taxes Online screen. Tax rates differ depending on where you live. Pay Real Estate Tax.

Box 90775 Henrico VA 23273-0775. Taxpayers can either pay online by visiting RVAgov or mail their payments. If you can answer YES to any of the following questions your vehicle is considered by state law to have a business use and does NOT qualify for personal property tax relief.

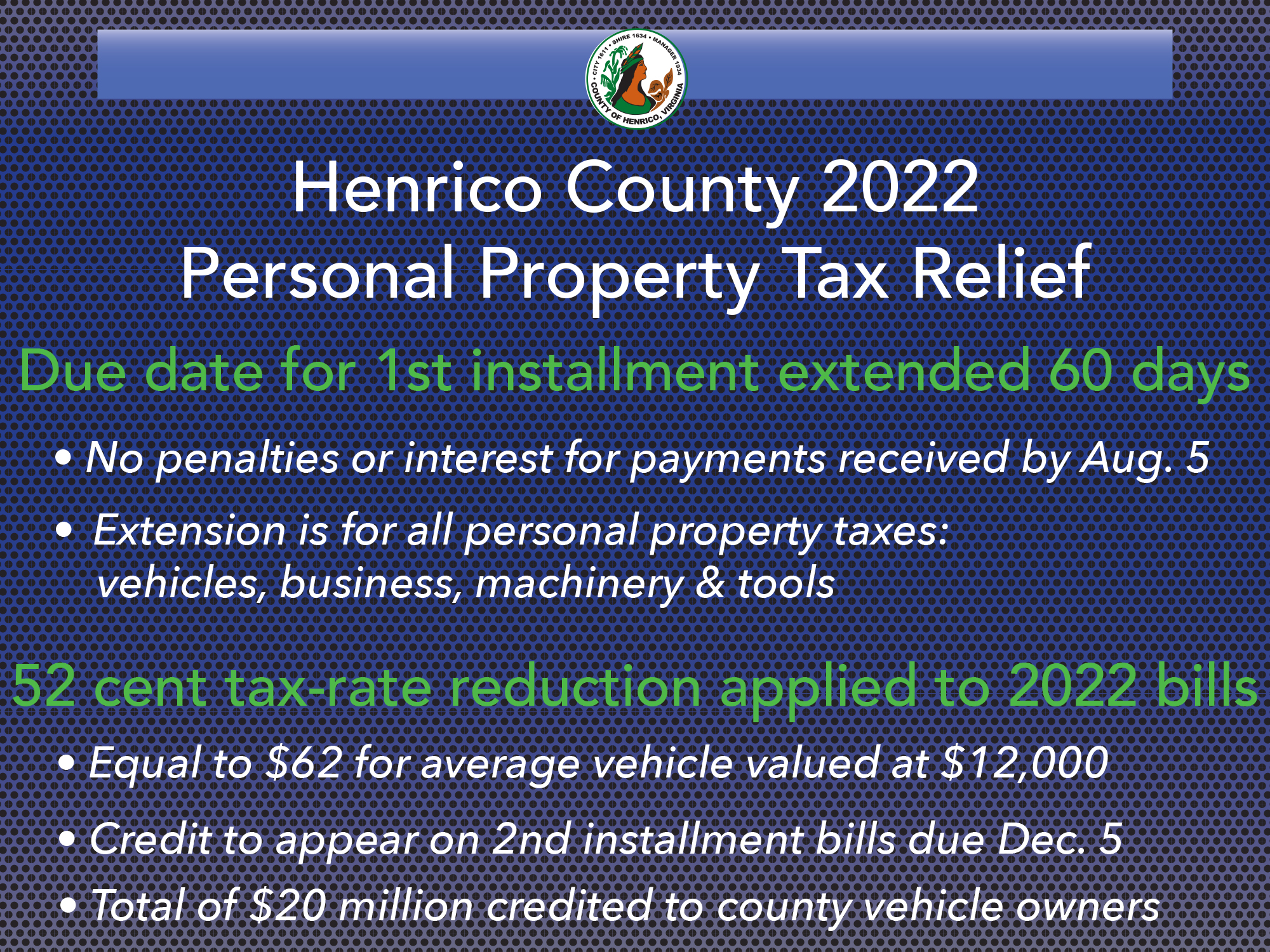

Henrico Proposes Personal Property Tax Relief To Offset Rising Vehicle Values Henrico County Virginia

/cloudfront-us-east-1.images.arcpublishing.com/gray/4ASPKZIKKZEKDBCSG3BYAZNXBM.jpg)

Richmond Personal Property Tax Payment Deadline Extended Until Aug 5

City Of Richmond Extends Personal Property Tax Deadline To August Wric Abc 8news

Paydayloans Mortgage Checklist Refinance Mortgage Mortgage

/cloudfront-us-east-1.images.arcpublishing.com/gray/4ASPKZIKKZEKDBCSG3BYAZNXBM.jpg)

Richmond Personal Property Tax Payment Deadline Extended Until Aug 5

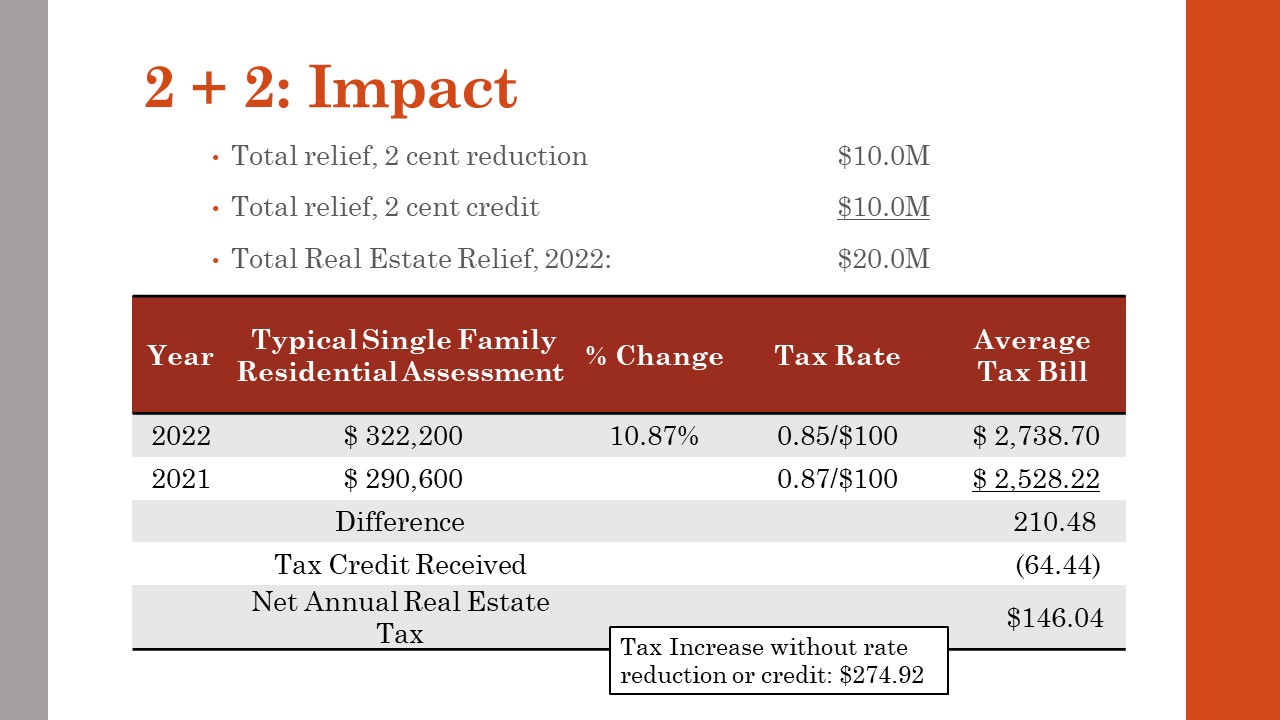

Henrico Approves Ordinance To Offer First Ever Real Estate Tax Credit Henrico County Virginia

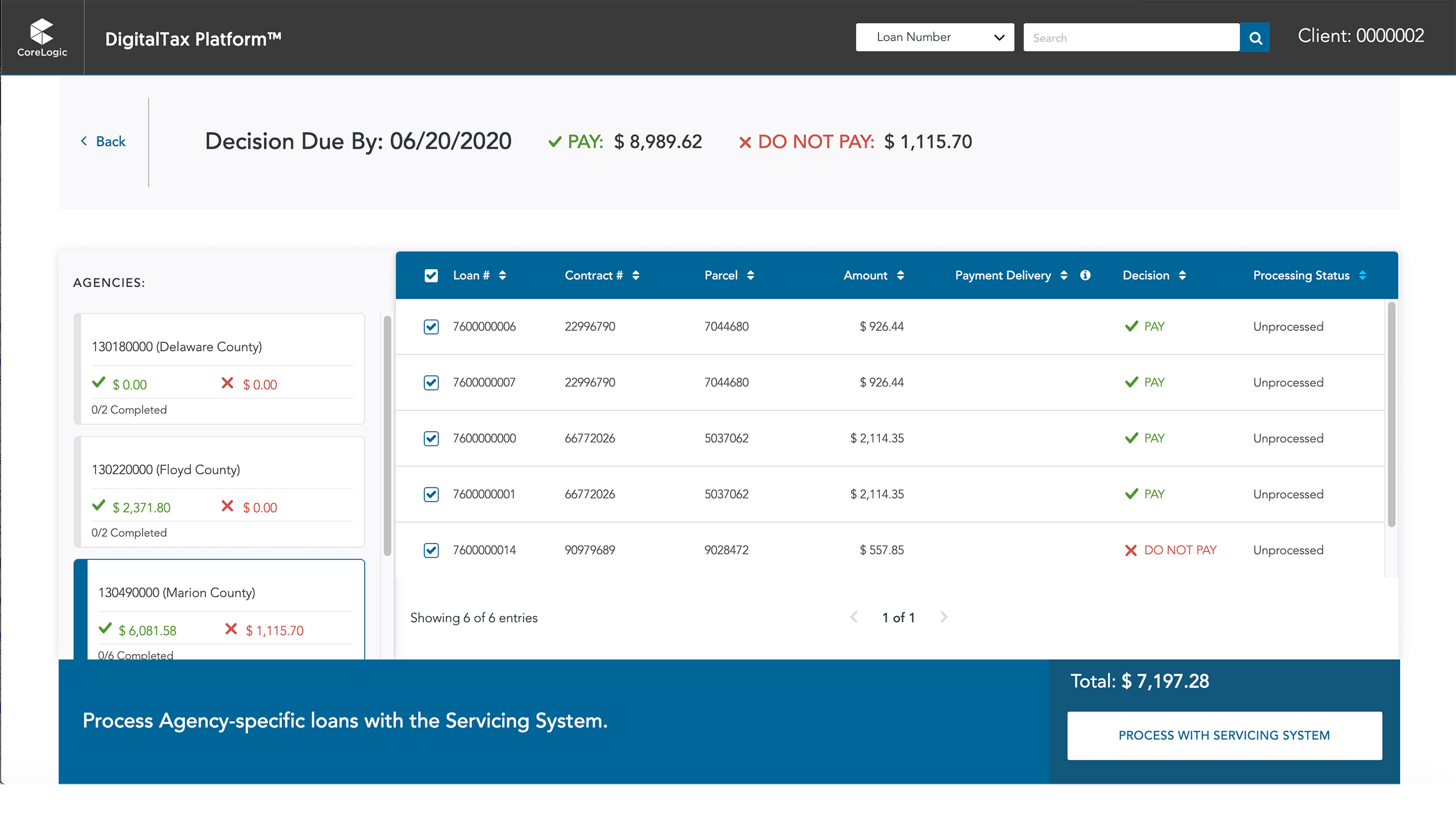

Residential Property Tax Solutions Corelogic

Payment Options Tax Administration

News Flash Goochland County Va Civicengage

Pay Online Chesterfield County Va

Residential Property Tax Solutions Corelogic

For The Love Of Old Houses Facebook Page Home Old Houses House

Taxmaster Finance Consulting Psd Template Psd Templates Finance Psd

Understanding Your Credit Score Nfm Lending Credit Score Understanding Yourself Understanding

Getting A Tax Refund Consider Using It For Your Down Payment Forza Real Estate Buying First Home Tax Refund Money Saving Strategies

Virginia Tax Rates Rankings Virginia State Taxes Tax Foundation

Residential Property Tax Solutions Corelogic

Taxmaster Finance Consulting Psd Template Finance Psd Templates Templates

Real Estate Tax Frequently Asked Questions Tax Administration